Intermediate Infrastructure Business Case

FOR THE REDEVELOPMENT OF THE HOWARD HAMILTON INTERNATIONAL AIRPORT (PROVIDENCIALES INTERNATIONAL AIRPORT)

Turks and Caicos Islands Airports Authority

It is the pleasure of the TCIAA and the Government of the Turks and Caicos Islands itself to present this Intermediate Business Case for the proposed airport PPP project under the UK Government International Guidance for Infrastructure Business Case. It is important to note that this Intermediate Business Case is being presented in compliance with the Public Procurement Ordinance and need for approval before moving the Procurement Stage of the Project.

The project team and its advisors have demonstrated a remarkable level of advance and robustness in their analysis and planning for the project. As such, this Intermediate Business Case represents a critical milestone in the development of the airport PPP project, building on earlier feasibility studies and providing a more detailed analysis of its potential benefits for the society and the economic development but also a thorough assessment of the project-related risks.

Business Case Annexes for Website

| # | Title | Document |

|---|---|---|

| 02 | Annex 1.1 Market and Traffic | Download |

| 03 | Annex 1.2 Indicative Development Plan & Investment Programme | Download |

| 04 | Annex 1.3 Environmental & Social Assessment | Download |

| 05 | Annex 1.4 Fees and Charges | Download |

| 06 | Annex 1.5 Business Plan | Download |

| 09 | Annex 2. PPP Options Considered | Download |

| 10 | Annex 3. Risk Assessment | Download |

| 11 | Annex 4. Cost Benefit Analysis | Download |

| 15 | Annex 8. Advisory.Steering Committee Terms of Reference | Download |

| 16 | Annex 9. First Site Visit Timetable | Download |

| 17 | Annex 10. Second Site Visit Timetable | Download |

The Turks and Caicos Islands (TCI) is lauded as a premium/niche Caribbean tourist destination, with traffic mainly composed of high-yield United States of America inbound tourists. The TCI also welcomes regularly scheduled flights from London, UK; Toronto, Canada; and the neighbouring Caribbean region. The TCI still has room to increase its touristic hotel offer density, the main driver for air traffic development.

The planning and development of modern and resilient airports to facilitate international travel into and throughout the Turks and Caicos Islands is a priority of the Turks and Caicos Islands Government through the Turks and Caicos Islands Airports Authority (“TCIAA”) and is a significant driver of economic development for the country.

The Howard Hamilton International Airport, formerly the Providenciales International Airport has proven to be inadequate in spacing with no scope for increased demands, particularly with the increase in international flights to the Turks and Caicos Islands as of November 2021. In 2020-2021, enforced COVID-19 protocols created further spacing limitations to an already small arrivals hall, resulting in the Turks and Caicos Islands Government (TCIG) having to look at new and innovative ways to expedite passenger processing through the arrival terminal (both Immigration and Customs), without compromising its Health and Safety and National Security obligations. The TCIG has identified the development of the Airport as a significant priority area during its current term. The Cabinet, as a preliminary, received and attended various unsolicited presentations for the redevelopment of the airport which were all varied in scope and proposal, making it abundantly clear that a consultancy is required to present the best options for the life of the redevelopment based on TCIG’s goals, preferred funding and managing mechanism. The TCIG intends to redevelop the Howard Hamilton International Airport, which will give it a life cycle of at least forty years. This entails the construction of a new terminal building, a parallel runway or taxiway, and auxiliary facilities, to improve the quality of the Airport’s services. To that end, the TCIG wishes to attract investment into the redevelopment project through a Public Private Partnership (PPP) or Public Finance Initiative (PFI).

In May 2022, upon the culmination of an open tender exercise, the Turks and Caicos Islands Airports Authority (“TCIAA”) contracted ALG Transport & Infrastructure Advisors PLC (“ALG”) as feasibility and transaction advisors for the Howard Hamilton International Airport Redevelopment Project (procured through the Providenciales International Airport Redevelopment Project, TCIG Tender Reference 21/43). The scope of the engagement was and remains to specifically assist the TCIAA in conducting technical, legal, environmental, and financial assessments of the Airport to:

- define an appropriate scope, structure and risk allocation for the Public Private Partnership (PPP) or Public Finance Initiative (PFI) transaction through the required technical and legal studies to ensure maximum value for the use of public resources for the modernization and operation of the airport;

- develop a comprehensive Invitation to Tender for the tendering process;

- conduct a transparent tendering procedure to attract a private investor to finance, design, expand, operate and maintain the airport; and

- lead in the implementation of the PPP

The project for which ALG is engaged is divided into three (3) Phases:

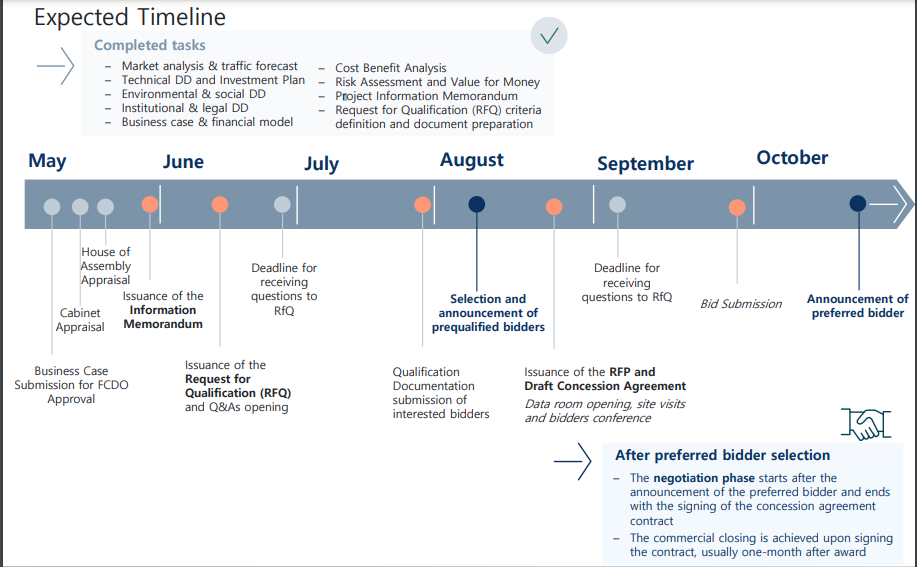

a) Phase I: The conduct of technical studies, finance, legal due diligence, and the identification of a preliminary transaction structure. This phase required the consultant to further conduct a review of the Airport and produce a report with a specific focus on the economic feasibility, and provide a baseline for the TCIAA for a better assessment during the tendering process, and to ensure that informed decisions can be taken on the way forward with the project. It also required identification of the basics for the required tasks concerning due diligence and transaction structuring along with the required document drafting to ensure Value for Money (VfM) is achieved and to support any approvals required as per the TCI’s Public Finance Management Ordinance (PFMO) and the Public Procurement Ordinance (PPO).

b) Phase II: The conduct of the tender, evaluation, and pre-award of the project. This phase, subject to approval to proceed with the procurement; will focus on the preparation of data and documents related to the tendering process for the assignment of the concession of the Airport including Project Information Memorandum, Invitation for Prequalification (IFP), Invitation to Tender (ITT), legal/tender evaluation criteria and Draft PPP Contract.

c) Phase III: This phase will be oriented toward the achievement of commercial and financial closure with the Preferred Bidder and the final award of the contract. This phase will further be defined as per the guidance of the Consultant.

In the conduct of its function as transaction advisor, ALG is assisted by the Gide Loyrette Nouel (GIDE) a global law firm based in France with representation in the United Kingdom. The delivery model of ALG in phase 1 consisted of the following activities:

d) An initial site visit was conducted to assess needs and to determine whether there was an appetite for investment;

e) A follow-up site visit comprised of workshops and a stakeholder engagement was conducted to further identify the market needs, the feasibility of the development and the value for money (MfV) for an investment, and to determine the evaluation criteria and weightings for shortlisted models.

It is the position of TCIAA that the preferred option for the redevelopment of the Airport is a PPP and a business case to acquire the necessary TCIG and UK approvals to move forward with a procurement targeting such a financing scheme is currently being prepared for consideration in early spring 2023.

With sustainable development, the TCI could reach on a conservative analysis 1 Million tourists annually by 2025, indicating a demand of 2.2 million passenger movements annually through the Howard International Airport. The TCI, therefore, requires a fine-tuned investment programme for the redevelopment of the Airport through an investment programme targeting improved infrastructure needs for the airport’s airfield, apron, passenger terminal building (PTB), and surface access.

To achieve the satisfaction of the identified infrastructure needs an investment strategy defined under three categories of investment is being proposed:

- expansion CapEx;

- compliance CapEX; and

- maintenance CapEx.

The Expansion CapEx correlates to investment actions required to develop the airport’s infrastructure and processing ability. This includes the addition of new infrastructure, equipment and/or systems not previously existing. The Compliance CapEx relates to the investment required to align the airport’s infrastructure to the standard and recommended practices (SARPs) of the International Civil Aviation Organisation (ICAO), mainly regarding the safety and security of the operation. This investment is intended to adopt the form of capital investment actions or major maintenance actions and replacement actions needed within the first four years of the redevelopment project. The Maintenance CapEx relates to the investment required to “maintain the good and safe operating condition of the existing infrastructure.” This concerns the lifecycle of the asset to be built under the first investment category and should a PPP model be pursued, a minimum maintenance plan will be required of bidders as well as a commitment to carry out the proposed maintenance plan.

In addition to identifying three investment categories, it is further proposed that redevelopment take place over two distinct construction phases intended to increase the airport’s capacity as quickly as possible:

- quick wins phase: to be completed over a 1.2 to 2-year period and includes the implementation of a new turn pad (airside); increasing the apron size by 282,000 sqft; and the expansion of the existing passenger terminal by 26,700 sqft to increase terminal capacity from 0.9Mpax to 1.1- 1.6Mpax. The TCIAA has already embarked on this exercise.

- Short/Mid Term developments: to be completed over a 3-4 year period and includes adding an airside taxiway for departures and a separate taxiway for arrivals (increasing airfield capacity from 14ATMs/h to 26-28 ATMs/h); increasing the apron by an additional 110,555 sqft; the construction of a new passenger terminal building of at least 270,000 sqft; and the expansion of the surface areas to include new car parking capacity and improved access.

Under the proposed programme, the TCIAA will retain ownership of the Airport (“Asset”) with there being a maximum 30-year period for the funding/payback arrangement. Thus, the asset at all times will remain the property of the people of the Turks and Caicos Islands. It is envisioned that through a meticulously designed and executed procurement exercise involving a pre-qualification stage, a renowned international airport operator would be engaged for the operation and maintenance of the asset while the construction of the asset will be via a local investor or a consortium thereof, who would in the process of preparing themselves for construction of the project contract the requisite skills and project experts experienced in the construction of airports within the similar scope contemplated. The project Finance mechanism will require the incurrence of a 70% Private Debt / 30% Equity for CapEx Expansion. There will be no impact on TCIG’s debt status. TCIG’s remuneration will be the result of a PPP revenue share scheme.

Programme Governance

If approved, the PPP programme will principally governed by TCI’s Procurement Laws as set out in TCI’s Public Procurement Ordinance (“PPO”), Public Finance Management Ordinance (“PFMO”), alongside the Turks and Caicos Islands Airports Authority Ordinance (“AAO”) and their corresponding regulations. The PPO and PFMO provide for general good governance principles in PPP procurements, with the PPO requiring that the procurement be conducted in a manner that ensures competition which is appropriate, fair, transparent, and ethical, and ensures that the highest standards of probity are observed by officers involved in the procurement. Principally, Sections 34(2) of the PPO and 22(13) of the PFMO, in addition to requiring approval from a Secretary of State, require that a project where PPP, PFI, or any other alternative method of funding is contemplated to have:

- a sound appraisal underpinning the proposed project before the financing means has been determined;

- a financial appraisal demonstrating improved value for money against a conventionally financed alternative;

- a long-term affordability case assessed and agreed upon by the appropriate technical experts retained by the government (which in this case has been executed through the TCIAA’s contracting of ALG as consultants); and

- an independent opinion from a qualified accountant of good standing on the correct accounting treatment in the government’s accounts.

The programme envisions the use of a prequalification procurement procedure (one of three procurement procedures allowed under the PPO, section 30(1)) which will involve the publication of an invitation for submissions from potential contractors on a list of all potential contractors that have been granted a specific license or comply with a legal requirement, where the license of compliance with any legal requirement essential to the conduct of the procurement.

Stakeholder engagement throughout the programme will be vital. The TCIAA wishes the public to be fully informed and fully consulted with at all phases of the programme. This page is intended to facilitate ongoing stakeholder engagement and will be updated with information throughout the project. Interested persons should consult this page regularly and/or join our email e-news list here to receive frequent updates.

The Goverment of the Turks & Caicos Islands

PROVIDENCIALES INT’L AIRPORT (PLS) REDEVELOPMENT PROJECT TECHNICAL, FINANCIAL AND LEGAL CONSULTANT

Stakeholder Session

20th July 2022